2017 Top 500: Capitalizing on Strength

From risk-taking home improvement entrepreneurs to slow-and-steady full-service companies, an uptick in demand and new leads made winners of most remodeling firms on the 2017 Top 500.

See the 2017 Top 500 list

here

.

Operating in one of the longest economic expansions in U.S. history, remodelers are finding opportunity, overcoming obstacles and growing year-over-year.

This is true for the industry’s largest firms, those that comprise the QR Top 500. Together, the group is experiencing a 10.4 percent compounded annual growth rate since the beginning of 2013. And for the most recent reporting year, it represents $8.97 billion in gross revenue on 1,147,911 remodeling jobs.

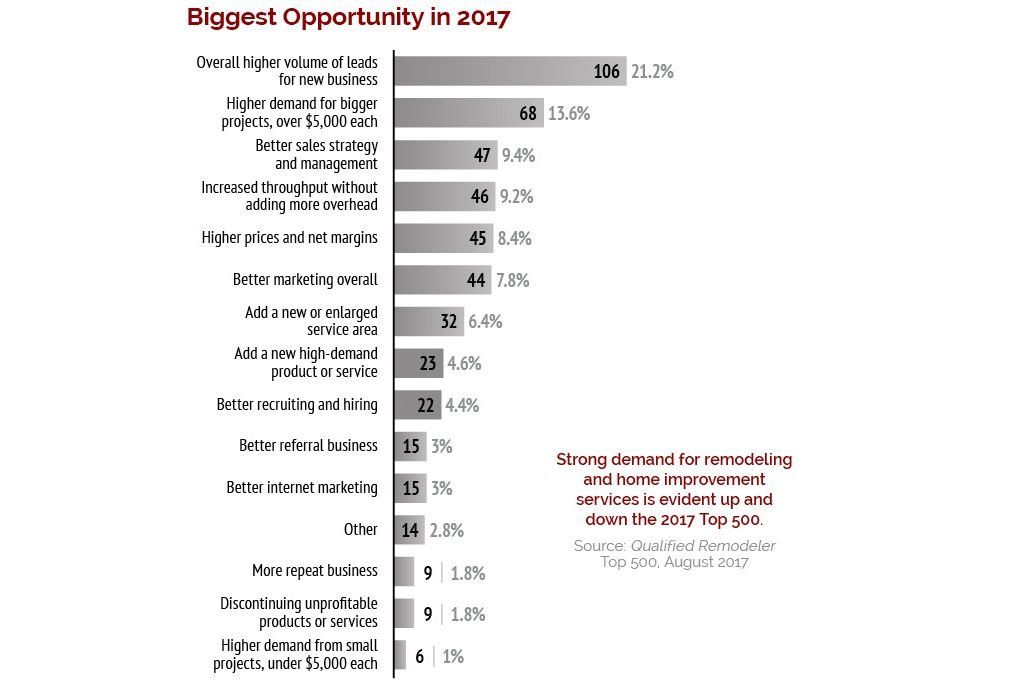

Remarkably, the growth is balanced across firms representing all five segments of remodeling. Commonly cited opportunities include “stronger demand,” “more leads,” “more effective marketing,” and the ability to command “higher prices and margins.”

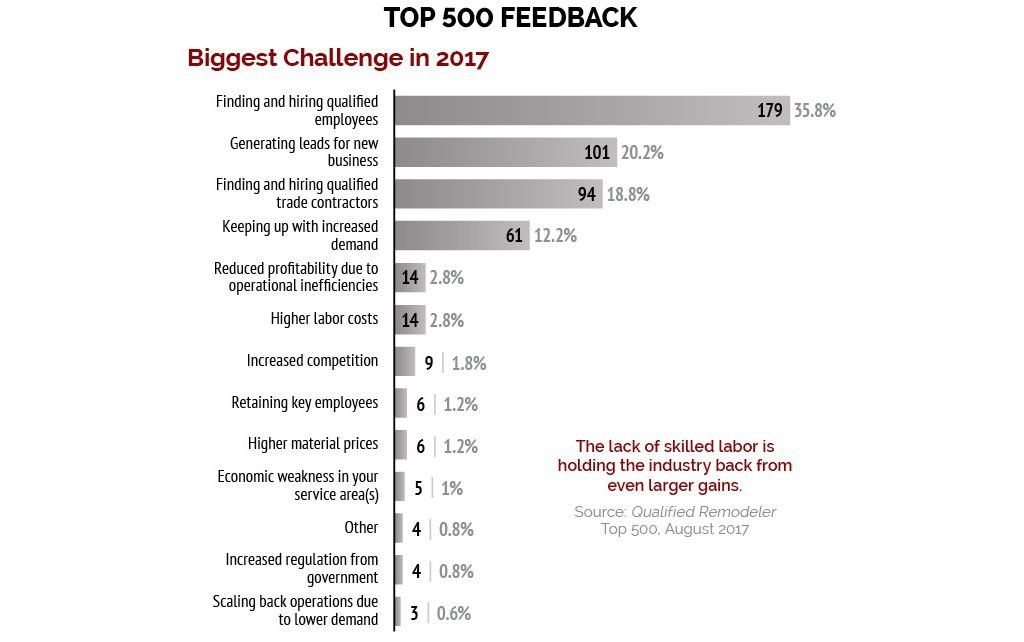

But challenges persist. At the top of the list is finding qualified field managers, sales personnel and skilled trades. All other challenges cited—from “keeping up with increased demand” to “higher costs”—pale in comparison to lack of labor.

Here’s a look at the primary segments.

Full-Service

One of most respected full-service firms in the U.S. is the northern Virginia-based Case Design/Remodeling, No. 44, with $29.6 million in remodeling revenue. In 2017, CEO Bruce Case says the company aims for 8 percent top-line growth in addition to a similar uptick last year.

“This year has represented healthy growth for us,” says Case, a second-generation leader. “It allows for opportunity while also keeping our focus on inspiring our clients.”

Case says the company views “opportunity” broadly and as a benefit to new and existing employees. They offer job training and cross-training within the company as well as opportunities to “think-through a business challenge,” he says. Title and compensation are only a part of the mix.

Design/Build

Some of the names that represent the design-build segment of the 2017 Top 500 include New York City-based No. 13, SilverLining, Inc.; Portland, Oregon-based No. 34, Neil Kelly Company; and Chicago-based No. 42, The Airoom Companies. These firms are capitalizing on more and better leads from the internet, bolstering repeat and referral sources.

A growing number of big jobs as well as a larger influx of leads are driving this segment. This stands to reason. Design-build is a cyclical category with very-high highs, and very-low lows. Many design-build firms did not survive the Great Recession. Those that did are now thriving as a result of economic expansion, a bullish stock market and higher incomes.

Kitchen & Bath Specialists

Traditionally, this group is represented by firms like No. 258, Ulrich Inc., which has maintained a big showroom in Ridgewood, New Jersey, since the 1960s. Its team of designers cultivates clients and conducts weeks of design before a project is slotted for construction. Increasingly, the segment is also being represented by fast-growing, single-line firms that specialize in moderately priced offerings, such as cabinet refacing and replacement baths.

Firms like Ulrich rely heavily on repeat and referral business while others, like No. 9, Bath Fitter, and No. 46, Kitchen Magic, are sales and marketing juggernauts. This combination of firms clarifies the reason for an average marketing spend of 8.8 percent of revenue last year.

Home Improvement/Replacement

Windows, roofing, siding, gutters, decks, basements and sunrooms are just few of the specialties around which many of the industry’s largest firms are built. This segment is represented by firms high, low and throughout the Top 500 list. These firms are characterized by high volumes of moderately priced home improvements.

The best firms have solid recruiting and compensation practices in place. To facilitate growth, they must recruit and train sales staff. It is a constant challenge, but one the biggest and most successful firms meet every day.

Top sources for leads include home shows, direct mail, radio and television, as well as the internet.

Insurance Restoration

Relationships with insurance providers are the key driver of this segment. The No. 1 company on the list, with $1.4 billion in revenues, Belfor Holdings Inc., capitalizes on having served insurers for many decades. And increasingly, discretionary remodeling projects are a big part of what Belfor offers its customers, notes the company’s founder and CEO, Sheldon Yellen.

Altogether, there are 34 dedicated insurance restoration firms on the 2017 Top 500. These firms tend to operate on tighter margins approved by large insurance carriers.

In many ways, the 2017 Top 500 is a composite of the larger industry. The group’s challenges and opportunities as well as its successes mirror those experienced by the 80,000 plus firms with payroll that compete for jobs across all 50 states. Right now, the image in the mirror is that of a healthy industry in the midst of a good run. |

QR

See the complete 2017 Top 500 list

here .